February 14, 2006

By EDMUND L. ANDREWS

nytimes.com

WASHINGTON, Feb. 13 - The federal government is on the verge of one

of the biggest giveaways of oil and gas in American history, worth an

estimated $7 billion over five years.

New projections, buried in the Interior Department's just-published

budget plan, anticipate that the government will let companies pump

about $65 billion worth of oil and natural gas from federal territory

over the next five years without paying any royalties to the government.

Based on the administration figures, the government will give up more

than $7 billion in payments between now and 2011. The companies are

expected to get the largess, known as royalty relief, even though the

administration assumes that oil prices will remain above $50 a barrel

throughout that period.

Administration officials say that the benefits are dictated by laws

and regulations that date back to 1996, when energy prices were

relatively low and Congress wanted to encourage more exploration and

drilling in the high-cost, high-risk deep waters of the Gulf of Mexico.

"We need to remember the primary reason that incentives are given,"

said Johnnie M. Burton, director of the federal Minerals Management

Service. "It's not to make more money, necessarily. It's to make more

oil, more gas, because production of fuel for our nation is essential

to our economy and essential to our people."

But what seemed like modest incentives 10 years ago have ballooned to

levels that have alarmed even ardent supporters of the oil and gas

industry, partly because of added sweeteners approved during the

Clinton administration but also because of ambiguities in the law

that energy companies have successfully exploited in court.

Short of imposing new taxes on the industry, there may be little

Congress can do to reverse its earlier giveaways. The new projections

come at a moment when President Bush and Republican leaders are on

the defensive about record-high energy prices, soaring profits at

major oil companies and big cuts in domestic spending.

Indeed, Mr. Bush and House Republicans are trying to kill a one-year,

$5 billion windfall profits tax for oil companies that the Senate

passed last fall.

Moreover, the projected largess could be just the start. Last week,

Kerr-McGee Exploration and Development, a major industry player,

began a brash but utterly serious court challenge that could, if it

succeeds, cost the government another $28 billion in royalties over

the next five years.

In what administration officials and industry executives alike view

as a major test case, Kerr-McGee told the Interior Department last

week that it planned to challenge one of the government's biggest

limitations on royalty relief if it could not work out an acceptable

deal in its favor. If Kerr-McGee is successful, administration

projections indicate that about 80 percent of all oil and gas from

federal waters in the Gulf of Mexico would be royalty-free.

"It's one of the greatest train robberies in the history of the

world," said Representative George Miller, a California Democrat who

has fought royalty concessions on oil and gas for more than a decade.

"It's the gift that keeps on giving."

Republican lawmakers are also concerned about how the royalty relief

program is working out.

"I don't think there is a single member of Congress who thinks you

should get royalty relief at $70 a barrel" for oil, said

Representative Richard W. Pombo, Republican of California and

chairman of the House Resources Committee.

"It was Congress's intent," Mr. Pombo said in an interview on Friday,

"that if oil was at $10 a barrel, there should be royalty relief so

companies could have some kind of incentive to invest capital. But at

$70 a barrel, don't expect royalty relief."

Tina Kreisher, a spokeswoman for the Interior Department, said Monday

that the giveaways might turn out to be less than the basic forecasts

indicate because of "certain variables."

The government does not disclose how much individual companies

benefit from the incentives, and most companies refuse to disclose

either how much they pay in royalties or how much they are allowed to

avoid.

But the benefits are almost entirely for gas and oil produced in the

Gulf of Mexico.

The biggest producers include Shell, BP, Chevron and Exxon Mobil as

well as smaller independent companies like Anadarko and Devon Energy.

Executives at some companies, including Exxon Mobil, said they had

already stopped claiming royalty relief because they knew market

prices had exceeded the government's price triggers.

About one-quarter of all oil and gas produced in the United States

comes from federal lands and federal waters in the Gulf of Mexico.

As it happens, oil and gas royalties to the government have climbed

much more slowly than market prices over the last five years.

The New York Times reported last month that one major reason for the

lag appeared to be a widening gap between the average sales prices

that companies are reporting to the government when paying royalties

and average spot market prices on the open market.

Industry executives and administration officials contend that the

disparity mainly reflects different rules for defining sales prices.

Administration officials also contend that the disparity is illusory,

because the government's annual statistics are muddled up with big

corrections from previous years.

Both House and Senate lawmakers are now investigating the issue, as

is the Government Accountability Office, Congress's watchdog arm.

But the much bigger issue for the years ahead is royalty relief for

deepwater drilling.

The original law, known as the Deep Water Royalty Relief Act, had

bipartisan support and was intended to promote exploration and

production in deep waters of the outer continental shelf.

At the time, oil and gas prices were comparatively low and few

companies were interested in the high costs and high risks of

drilling in water thousands of feet deep.

The law authorized the Interior Department, which leases out tens of

millions of acres in the Gulf of Mexico, to forgo its normal 12

percent royalty for much of the oil and gas produced in very deep

waters.

Because it take years to explore and then build the huge offshore

platforms, most of the oil and gas from the new leases is just

beginning to flow.

The Minerals Management Service of the Interior Department, which

oversees the leases and collects the royalties, estimates that the

amount of royalty-free oil will quadruple by 2011, to 112 million

barrels. The volume of royalty-free natural gas is expected to climb

by almost half, to about 1.2 trillion cubic feet.

Based on the government's assumptions about future prices ? that oil

will hover at about $50 a barrel and natural gas will average about

$7 per thousand cubic feet ? the total value of the free oil and gas

over the next five years would be about $65 billion and the forgone

royalties would total more than $7 billion.

Administration officials say the issue is out of their hands, adding

that they opposed provisions in last year's energy bill that added

new royalty relief for deep drilling in shallow waters.

"We did not think we needed any more legislation, because we already

have incentives, but we obviously did not prevail," said Ms. Burton,

director of the Minerals Management Service.

But the Bush administration did not put up a big fight. It strongly

supported the overall energy bill, and merely noted its opposition to

additional royalty relief in its official statement on the bill.

By contrast, the White House bluntly promised to veto the Senate's

$60 billion tax cut bill because it contained a one-year tax of $5

billion on profits of major oil companies.

The House and Senate have yet to agree on a final tax bill.

The big issue going forward is whether companies should be exempted

from paying royalties even when energy prices are at historic highs.

In general, the Interior Department has always insisted that

companies would not be entitled to royalty relief if market prices

for oil and gas climbed above certain trigger points.

Those trigger points ? currently about $35 a barrel for oil and $4

per thousand cubic feet of natural gas ? have been exceeded for the

last several years and are likely to stay that way for the rest of

the decade.

So why is the amount of royalty-free gas and oil expected to double

over the next five years?

The biggest reason is that the Clinton administration, apparently

worried about the continued lack of interest in new drilling, waived

the price triggers for all leases awarded in 1998 and 1999.

At the same time, many oil and gas companies contend that Congress

never authorized the Interior Department to set price thresholds for

any deepwater leases awarded between 1996 and 2000.

The dispute has been simmering for months, with some industry

executives warning the Bush administration that they would sue the

government if it tried to demand royalties.

Last week, the fight broke out into the open. The Interior Department

announced that 41 oil companies had improperly claimed more than $500

million in royalty relief for 2004.

Most of the companies agreed to pay up in January, but Kerr-McGee

said it would fight the issue in court.

The fight is not simply about one company. Interior officials said

last week that Kerr-McGee presented itself in December as a "test

case" for the entire industry. It also offered a "compromise," but

Interior officials rejected it and issued a formal order in January

demanding that Kerr-McGee pay its back royalties.

On Feb. 6, according to administration officials, Kerr-McGee formally

notified the Minerals Management Service that it would challenge its

order in court.

Industry lawyers contend they have a strong case, because Congress

never mentioned price thresholds when it authorized royalty relief

for all deepwater leases awarded from 1996 through 2000.

"Congress offered those deepwater leases with royalty relief as an

incentive," said Jonathan Hunter, a lawyer in New Orleans who

represented oil companies in a similar lawsuit two years ago that

knocked out another major federal restriction on royalty relief.

"The M.M.S. only has the authority that Congress gives it," Mr.

Hunter said. "The legislation said that royalty relief for these

leases is automatic."

If that view prevails, the government said it would lose a total of

nearly $35 billion in royalties to taxpayers by 2011 ? about the

same amount that Mr. Bush is proposing to cut from Medicare, Medicaid

and child support enforcement programs over the same period.

Fallujah Says it all

FALLUJAH - In 2004 the United States destroyed Fallujah. It was a war crime and a crime against humanity. This action typifies the U.S. invasion and occupation of Iraq. This video shows what happened, and what continues to happen daily if on a smaller scale.

Watch the video preview of

"Caught in the Crossfire".

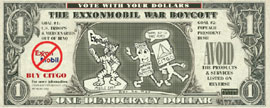

ConsumersForPeace.org, through the ExxonMobil War Boycott, is working to stop the killing in Iraq; to end the United States' occupation of Iraq; and to bring the perpetrators of the war to justice.

To assist you in boycotting ExxonMobil and firms connected to it through its board of directors, you may wish to have Democracy Dollars.

You may wish to write to the ExxonMobil Board of Directors