Shawn McCarthy

The Globe and Mail

NEW YORK -- Propelled by soaring world oil prices, ExxonMobil Corp. has become the world's largest corporation by revenue. But more important, says its chairman Rex Tillerson, is its industry-leading return on capital that he refuses to squander on the demands of politicians such as Newfoundland and Labrador Premier Danny Williams.

From Atlantic Canada to Venezuela to Indonesia to eastern Russia, Exxon is used to playing hardball, refusing to proceed with developments where governments insist on conditions that would lower the corporation's return on capital below what it considers to be an acceptable level.

ExxonMobil is the world's most successful oil company. It boasted a 31-per-cent return on capital employed last year, a full 50 per cent higher than its nearest competitor. It did so, Mr. Tillerson says, by sticking to its long-term strategy of investing in only the most profitable developments and strictly controlling costs.

The Irving, Tex.-based company refused requests for interviews with its new chairman, who took the helm at the beginning of the year, or with senior vice-president Stuart McGill. But in speeches, press conferences and analyst meetings, the executives have spelled out the company's strategy for staying on top while dealing with nationalistic political leaders, Middle East turmoil and what some analysts claim to be the coming peak for global oil production.

"The disciplined approach to pursuing and selecting the most attractive investment opportunities continues to distinguish ExxonMobil," Mr. Tillerson told analysts in New York last month. "We are long-term driven, and we're patient. And we're not opportunity constrained."

Last year, ExxonMobil earned $340-billion (U.S.) in revenue and a stunning $36-billion in profit, dethroning Wal-Mart Corp. as the largest publicly traded company by revenue.

Despite warnings of supply constraints in the face of rising demand, the global oil industry -- led by ExxonMobil -- has more projects in the pipeline than capital budgets and skilled manpower can handle at any one time.

It expects to increase its oil and gas output from the equivalent of four billion crude oil barrels a day, to five billion by 2010 and six billion by 2015. With a half-dozen major projects slated to come on stream each year for the next several years, Exxon is constantly re-evaluating its investments to determine which will provide the best long-term payoff.

In Fort McMurray, Alta., for example, the company is responding to soaring development costs with a go-slow approach to its Kearl oil sands project, which contains an estimated four billion barrels of crude oil.

"We are being judicious about the development pace, and designing strategies to mitigate the overheated cost environment in the Fort McMurray area," Mr. McGill told analysts. "We will invest in this large, high-quality resource when the project is ready and robust."

Given the ample opportunities worldwide, Newfoundland and Labrador is making a risky bet that the oil companies are engaging in negotiating tactics by shelving the Hebron offshore project. When a four-company consortium failed to reach agreement with Mr. Williams' government to develop the Hebron oil field in the waters off Newfoundland and Labrador, the operator, Chevron Corp. quickly reassigned its engineers and skilled work force to other projects around the globe.

The Premier has singled out consortium partner ExxonMobil, which owns the largest stake in the project, for its failure to proceed after the province demanded an equity stake. And, with Exxon in mind, he has threatened to pass legislation that would require companies to develop a known resource in a specified time frame or lose title to it.

Exxon officials refused to comment on the Newfoundland and Labrador logjam last week. Instead, they responded to a series of questions by drawing on past comments from Mr. Tillerson and Mr. McGill.

In contrast to analysts who argue the world should expect permanently higher oil prices, Exxon is less bullish, and bases its capital expenditures on a far more conservative outlook.

"There is really no explanation for why oil trades where it does today at these prices," Mr. Tillerson said in a recent speech. "If you look to the long term, our view is that supply and demand fundamentals are going to return to levels that are reflective of prices that are more in line with historic prices than today."

As a result, Exxon is not opening the spigots to throw money at resource development.

In fact, it allocated more to its share buyback program in 2005 than it did on its capital budget to expand production, with $23-billion spent on share repurchases compared with an $18-billion capital budget. It plans to increase that capital expenditure to $20-billion within a few years.

Exxon officials won't talk about Newfoundland, but its approach in Indonesia and Venezuela -- where it encountered government demands to increase public participation in projects -- speaks volumes.

In Indonesia, Mr. Tillerson concluded a deal with the government earlier this year that ended a five-year dispute over development of Indonesia's largest untapped oil field, an impasse that some in the country blamed for drying up foreign investment.

While Exxon is now prepared to proceed, the government fired the head of the national oil company, who had opposed the deal.

Similarly in Venezuela, Exxon has said it is prepared to work with President Hugo Chavez to develop the country's vast heavy oil resources. But it has rejected Mr. Chavez's demands for increased royalty rates, and said it will proceed with the project only if the investment climate is favourable.

"They'll either create the conditions that allow major new investments, or they will not create those conditions. And the major new investments then, at least for us, are unlikely to take place," Mr. Tillerson told the analysts in New York.

"We will remain interested in the country. We see opportunities there, and it's just a question of how they want to go forward."

(Thursday, April 20, 2006, B2)

CORRECTION

Exxon Mobil Corp. expects to increase its output from the equivalent of four million barrels of crude oil a day to five million by 2010 and six million by 2015. Incorrect information was published Monday.

Fallujah Says it all

FALLUJAH - In 2004 the United States destroyed Fallujah. It was a war crime and a crime against humanity. This action typifies the U.S. invasion and occupation of Iraq. This video shows what happened, and what continues to happen daily if on a smaller scale.

Watch the video preview of

"Caught in the Crossfire".

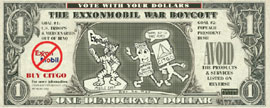

ConsumersForPeace.org, through the ExxonMobil War Boycott, is working to stop the killing in Iraq; to end the United States' occupation of Iraq; and to bring the perpetrators of the war to justice.

To assist you in boycotting ExxonMobil and firms connected to it through its board of directors, you may wish to have Democracy Dollars.

You may wish to write to the ExxonMobil Board of Directors